Poker News

-

News 10:45, Sep 25Artur Martirosian Named Triton Player of the Year 24/25

News 10:45, Sep 25Artur Martirosian Named Triton Player of the Year 24/25 -

News 10:21, Sep 25WPT Global Shuts Down Operations in India Ahead of Gaming Ban

News 10:21, Sep 25WPT Global Shuts Down Operations in India Ahead of Gaming Ban -

News 15:50, Sep 24Will New Jersey Make It Five? BetRivers Poker Expansion in Focus

News 15:50, Sep 24Will New Jersey Make It Five? BetRivers Poker Expansion in Focus -

News 12:38, Sep 23WCOOP 2025 Second Week Recap: Benny «RunGodLike» Glaser Extends His Own Record for Career Titles

News 12:38, Sep 23WCOOP 2025 Second Week Recap: Benny «RunGodLike» Glaser Extends His Own Record for Career Titles

-

News 08:29, Sep 23Artur Martirosian Wins His Third Triton Title and Is 99% Locked for the 2025 Triton POY Leaderboard

News 08:29, Sep 23Artur Martirosian Wins His Third Triton Title and Is 99% Locked for the 2025 Triton POY Leaderboard -

News 15:07, Sep 22From $1 to a $12,400 WPT World Championship Package: Your Personal Satellite Guide

News 15:07, Sep 22From $1 to a $12,400 WPT World Championship Package: Your Personal Satellite Guide -

News 12:23, Sep 22GGPoker Started an Olive Branch Amnesty Process: Players Can Apply Before October 1st, 2025

News 12:23, Sep 22GGPoker Started an Olive Branch Amnesty Process: Players Can Apply Before October 1st, 2025 -

News 11:17, Sep 19Christoph Vogelsang Wins $100K Triton Super High Roller Jeju II Main Event (*$4,099,975)

News 11:17, Sep 19Christoph Vogelsang Wins $100K Triton Super High Roller Jeju II Main Event (*$4,099,975) -

News 21:21, Sep 18The WPT World Championship Schedule Is Live and Here’s How You Can Still Qualify

News 21:21, Sep 18The WPT World Championship Schedule Is Live and Here’s How You Can Still Qualify -

News 20:00, Sep 17WCOOP 2025 First Week Recap: Blaz «Scarmak3r» Zerjav Wins Three Titles and Leads the Overall Leaderboard

News 20:00, Sep 17WCOOP 2025 First Week Recap: Blaz «Scarmak3r» Zerjav Wins Three Titles and Leads the Overall Leaderboard -

News 14:19, Sep 17Caesars Entertainment Holds the First Ever WSOP Online 2025 Fall With 33 Bracelets

News 14:19, Sep 17Caesars Entertainment Holds the First Ever WSOP Online 2025 Fall With 33 Bracelets -

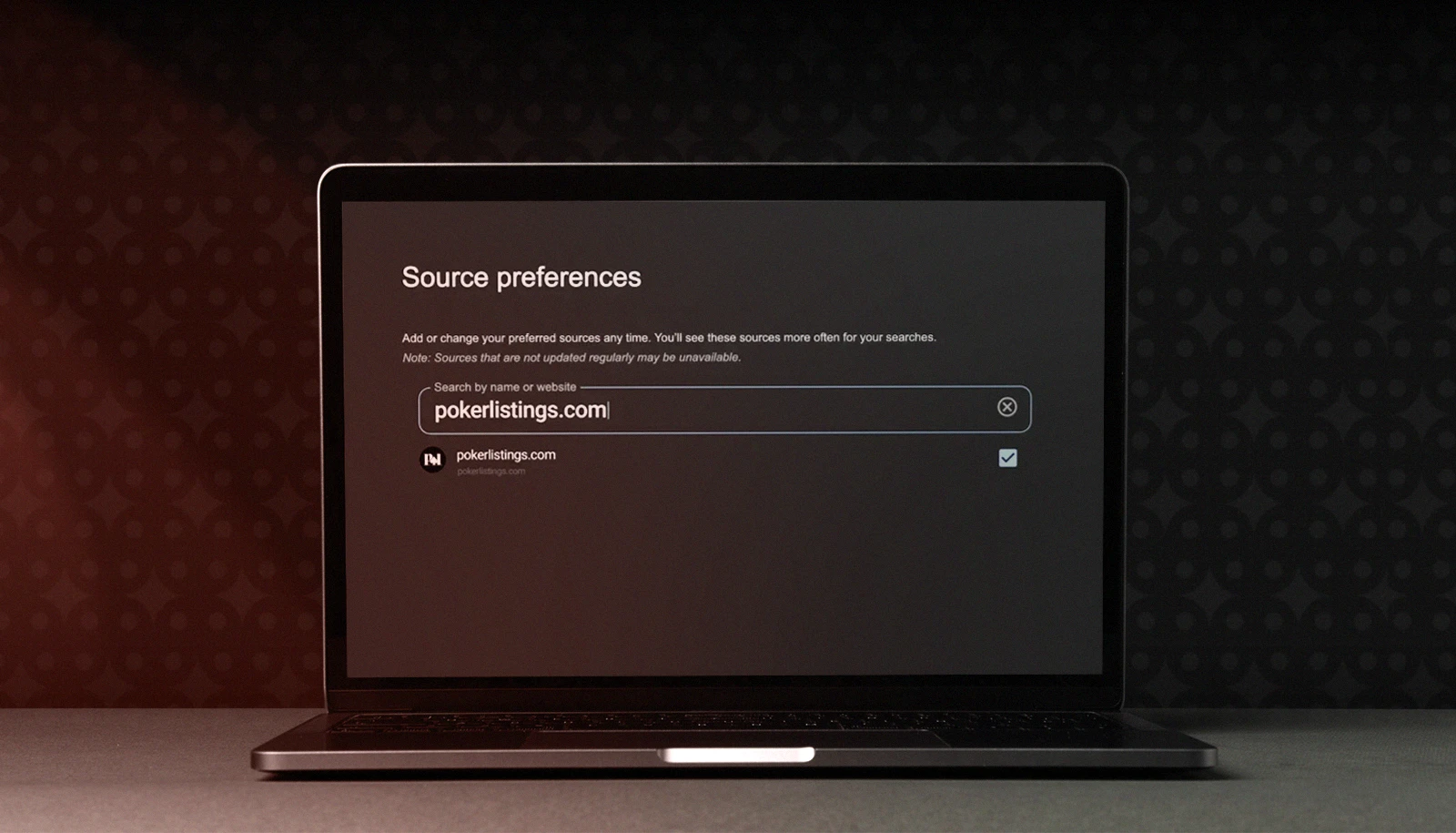

News 13:11, Sep 17Google Added Preferred Sources: Here’s How to Add PokerListings as a Preferred Source

News 13:11, Sep 17Google Added Preferred Sources: Here’s How to Add PokerListings as a Preferred Source -

News 09:36, Sep 17Card Strike Promo Is Back at 888poker

News 09:36, Sep 17Card Strike Promo Is Back at 888poker -

News 18:25, Sep 16RedStar Poker Announces Qualifiers for The Festival in Bratislava 2025

News 18:25, Sep 16RedStar Poker Announces Qualifiers for The Festival in Bratislava 2025 -

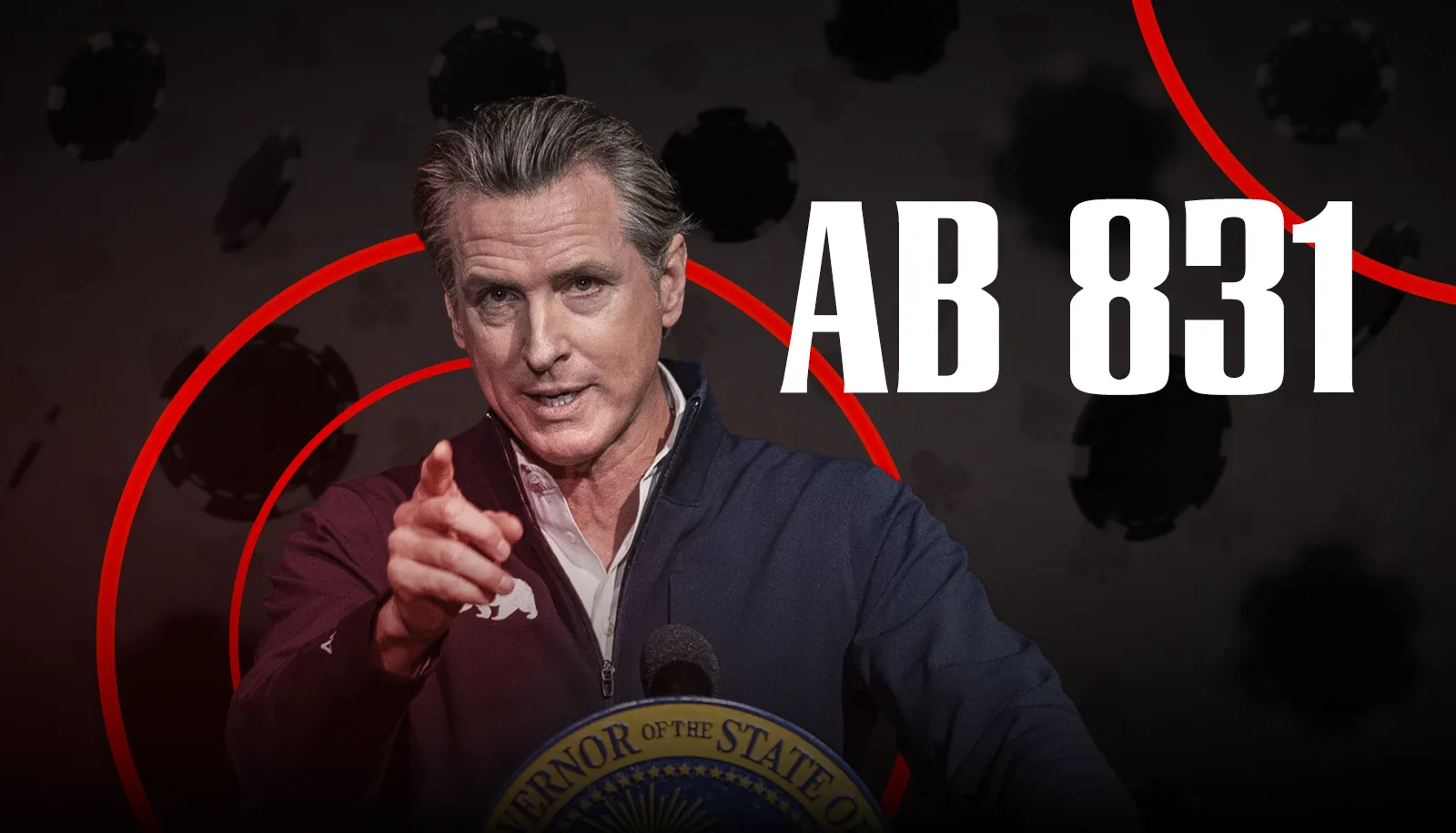

News 18:25, Sep 16AB 831 Moves to the Governor: Where Sweepstakes Poker Stands in California

News 18:25, Sep 16AB 831 Moves to the Governor: Where Sweepstakes Poker Stands in California -

News 19:48, Sep 15Punnat Punsri Keeps His Hot Streak Going With a $50K NLH 7-Handed Win ($1,697,000)

News 19:48, Sep 15Punnat Punsri Keeps His Hot Streak Going With a $50K NLH 7-Handed Win ($1,697,000) -

News 14:31, Sep 15PokerStars and DAZN Partner on UK Spin & Go Raffles

News 14:31, Sep 15PokerStars and DAZN Partner on UK Spin & Go Raffles -

News 08:00, Sep 15The Irish Poker Open 2026 Schedule is Here

News 08:00, Sep 15The Irish Poker Open 2026 Schedule is Here -

News 17:26, Sep 12Stephen Chidwick Triumphs in Unscheduled $200K Short Deck for $3.46M

News 17:26, Sep 12Stephen Chidwick Triumphs in Unscheduled $200K Short Deck for $3.46M -

News 16:26, Sep 12Sam Greenwood Said: “Ask Me Anything”…and Got Over 30 Questions on Reddit

News 16:26, Sep 12Sam Greenwood Said: “Ask Me Anything”…and Got Over 30 Questions on Reddit -

News 19:16, Sep 11XL Autumn Series Opens the 888poker Fall Season

News 19:16, Sep 11XL Autumn Series Opens the 888poker Fall Season -

News 16:16, Sep 11WPT Global Golden Bounty Championship Sets Record with Increased Guarantee

News 16:16, Sep 11WPT Global Golden Bounty Championship Sets Record with Increased Guarantee -

News 09:52, Sep 11World Poker Tour Launches WPT Wildcard: A Creator-Focused Poker Experiment

News 09:52, Sep 11World Poker Tour Launches WPT Wildcard: A Creator-Focused Poker Experiment -

News 16:31, Sep 10WPT Makes First-Ever Stop in Texas with WPT Prime Lodge Championship

News 16:31, Sep 10WPT Makes First-Ever Stop in Texas with WPT Prime Lodge Championship -

News 16:34, Sep 10WCOOP 2025: Scarmak3r and SerVlamin Hit a Double, Neymar Jr Reaches Top 7 in Super Tuesday

News 16:34, Sep 10WCOOP 2025: Scarmak3r and SerVlamin Hit a Double, Neymar Jr Reaches Top 7 in Super Tuesday -

News 11:12, Sep 10Mario Mosböck Named Official Triton Poker Ambassador

News 11:12, Sep 10Mario Mosböck Named Official Triton Poker Ambassador -

News 14:56, Sep 09Why Players Are Unhappy When Poker Rooms Refund Money After Banning Cheaters

News 14:56, Sep 09Why Players Are Unhappy When Poker Rooms Refund Money After Banning Cheaters -

News 11:26, Sep 09Joshua Gebissa Chops Heads-Up with Punnat Punsri and Wins the $8K Triton One Main Event (*$975,225)

News 11:26, Sep 09Joshua Gebissa Chops Heads-Up with Punnat Punsri and Wins the $8K Triton One Main Event (*$975,225)

For nearly two decades PokerListings has been covering the biggest moments in poker – from the legendary WSOP 2006 in Las Vegas to the shock of Poker Black Friday in 2011 and the launch of the first fully legal US online poker room. Today, we continue that tradition with fresh daily updates, breaking news, tournament coverage, player stories, and expert insights that keep you connected to the fast-moving poker world.