Poker News

-

News 18:54, Dec 17ACR Poker Offers Time-Limited Reload Bonus & Xmas Special PKO on MOSS

News 18:54, Dec 17ACR Poker Offers Time-Limited Reload Bonus & Xmas Special PKO on MOSS -

News 18:56, Dec 17EPT Prague: Matan Krakow Wins €5,300 Main Event For €778,255

News 18:56, Dec 17EPT Prague: Matan Krakow Wins €5,300 Main Event For €778,255 -

News 14:08, Dec 17WSOP Links Three Live Stops in New Player of the Year System

News 14:08, Dec 17WSOP Links Three Live Stops in New Player of the Year System -

News 18:03, Dec 15888poker Rolls Out Happy Holidays Sale Week With Half-Price Buy-ins

News 18:03, Dec 15888poker Rolls Out Happy Holidays Sale Week With Half-Price Buy-ins

-

News 15:44, Dec 14US Live Tournament Poker – Is It About to Die?

News 15:44, Dec 14US Live Tournament Poker – Is It About to Die? -

News 13:32, Dec 13Aleks Ponakovs Gets The Monkey Off His Back With His First Triton Title

News 13:32, Dec 13Aleks Ponakovs Gets The Monkey Off His Back With His First Triton Title -

News 20:26, Dec 12Push Hard —> Reset —> Repeat: The Inevitable Cycle of Being a Poker Pro

News 20:26, Dec 12Push Hard —> Reset —> Repeat: The Inevitable Cycle of Being a Poker Pro -

News 11:35, Dec 12PokerPlanets Is Running Two New Promotions From December 12 To 14

News 11:35, Dec 12PokerPlanets Is Running Two New Promotions From December 12 To 14 -

News 08:31, Dec 12PokerStars Launches $10,000,000 Winter Series for Southern Europe

News 08:31, Dec 12PokerStars Launches $10,000,000 Winter Series for Southern Europe -

News 20:09, Dec 11TDA + WPF Continental Summit: Brazil Brings Together More Than 200 Tournament Leaders

News 20:09, Dec 11TDA + WPF Continental Summit: Brazil Brings Together More Than 200 Tournament Leaders -

News 11:09, Dec 10PokerListings Freerolls Passwords — December 11

News 11:09, Dec 10PokerListings Freerolls Passwords — December 11 -

News 15:21, Dec 10ACR Poker Has Announced The Dual Venom Mystery Bounty for Winter 2026

News 15:21, Dec 10ACR Poker Has Announced The Dual Venom Mystery Bounty for Winter 2026 -

News 14:41, Dec 10Kayhan Mokri Extends His Incredible Upswing With A Victory In The $250K WSOP Paradise Triton Invitational ($7.7M)

News 14:41, Dec 10Kayhan Mokri Extends His Incredible Upswing With A Victory In The $250K WSOP Paradise Triton Invitational ($7.7M) -

News 14:30, Dec 10ACR and PokerListings Wrap up First Week of Christmas Promo

News 14:30, Dec 10ACR and PokerListings Wrap up First Week of Christmas Promo -

News 08:25, Dec 10GGPoker Announced $100M Winter Giveaway Series

News 08:25, Dec 10GGPoker Announced $100M Winter Giveaway Series -

News 00:04, Dec 10Yulian Bogdanov Wins EPT Prague PokerStars Open for €398,135

News 00:04, Dec 10Yulian Bogdanov Wins EPT Prague PokerStars Open for €398,135 -

News 17:21, Dec 09Biluzin Wins CoinPoker’s High Stakes Cash Game World Championship

News 17:21, Dec 09Biluzin Wins CoinPoker’s High Stakes Cash Game World Championship -

News 14:30, Dec 09Win the WPT Global €100,000 Live Champion Bonus at The Festival Bratislava 2026

News 14:30, Dec 09Win the WPT Global €100,000 Live Champion Bonus at The Festival Bratislava 2026 -

News 20:35, Dec 09ClubWPT Gold Pulls Out of New York as New Law Targets Dual-Currency Poker

News 20:35, Dec 09ClubWPT Gold Pulls Out of New York as New Law Targets Dual-Currency Poker -

News 11:23, Dec 09JackPoker Brings Back Its Cash Advent Calendar: 21 Days of Daily Quests and Gifts

News 11:23, Dec 09JackPoker Brings Back Its Cash Advent Calendar: 21 Days of Daily Quests and Gifts -

News 09:12, Dec 09Triton Invitational Sets New Record; Eibinger And Soverel Win Bracelets in PLO Tournaments

News 09:12, Dec 09Triton Invitational Sets New Record; Eibinger And Soverel Win Bracelets in PLO Tournaments -

News 13:51, Dec 08MOSS Returns to ACR Poker with a $2,500,000 Guarantee

News 13:51, Dec 08MOSS Returns to ACR Poker with a $2,500,000 Guarantee -

News 11:17, Dec 06Mario Mosböck launched YouTube channel

News 11:17, Dec 06Mario Mosböck launched YouTube channel -

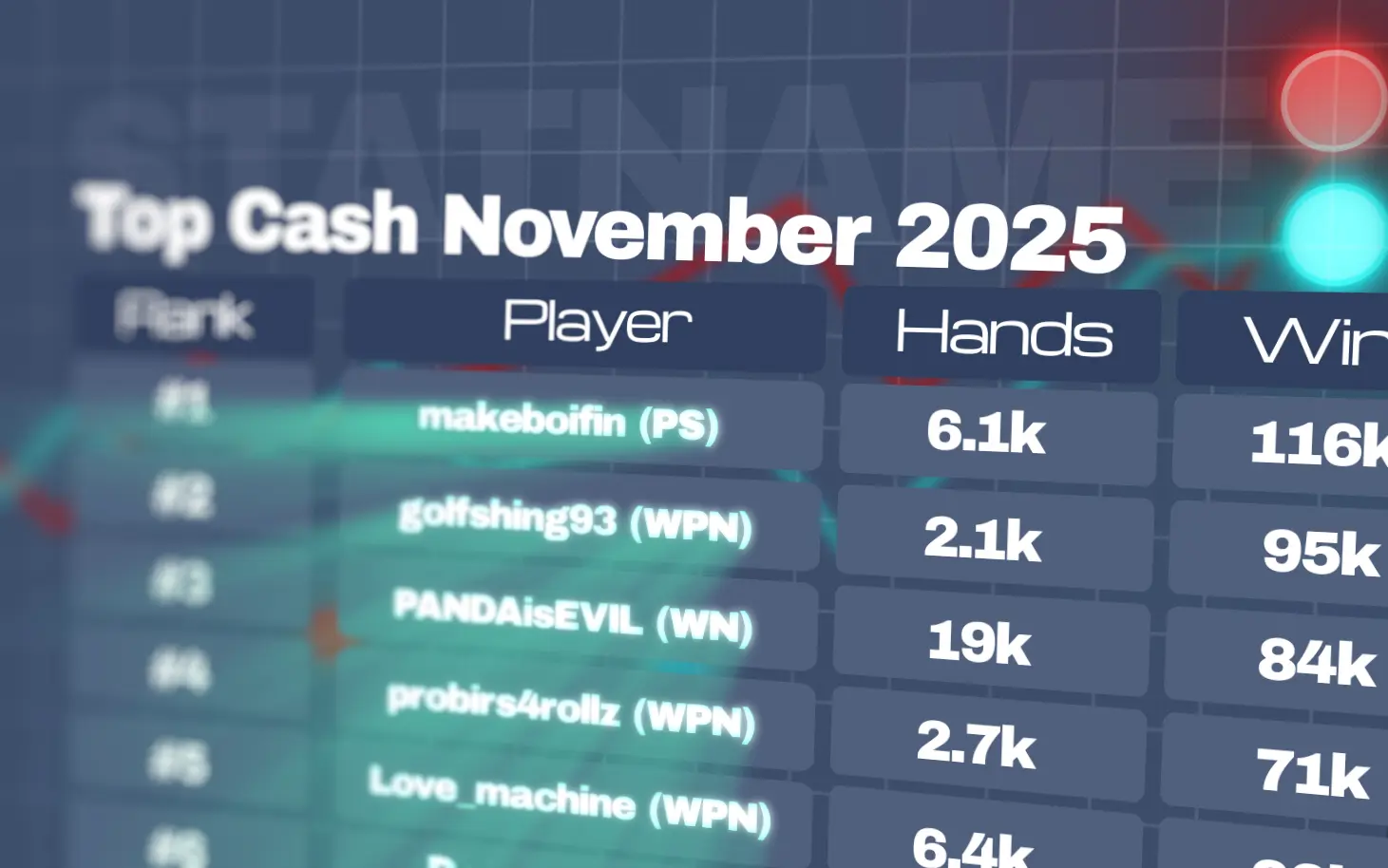

News 14:09, Dec 05Top Cash Game Players November 2025

News 14:09, Dec 05Top Cash Game Players November 2025 -

News 11:18, Dec 052026 WSOP Circuit Schedule: New Format, Bonuses, and WSOP+ App Integration

News 11:18, Dec 052026 WSOP Circuit Schedule: New Format, Bonuses, and WSOP+ App Integration -

News 12:57, Dec 04SCOOP 2026 Swaps Seasons: PokerStars Moves up Spring Series

News 12:57, Dec 04SCOOP 2026 Swaps Seasons: PokerStars Moves up Spring Series -

News 12:20, Dec 04888poker’s December Festival Is Here, with Freerolls Every Sunday

News 12:20, Dec 04888poker’s December Festival Is Here, with Freerolls Every Sunday -

News 19:42, Dec 03Best Online Poker Room Promotions in December 2025

News 19:42, Dec 03Best Online Poker Room Promotions in December 2025

For nearly two decades PokerListings has been covering the biggest moments in poker – from the legendary WSOP 2006 in Las Vegas to the shock of Poker Black Friday in 2011 and the launch of the first fully legal US online poker room. Today, we continue that tradition with fresh daily updates, breaking news, tournament coverage, player stories, and expert insights that keep you connected to the fast-moving poker world.