Poker News

-

News 11:18, Dec 052026 WSOP Circuit Schedule: New Format, Bonuses, and WSOP+ App Integration

News 11:18, Dec 052026 WSOP Circuit Schedule: New Format, Bonuses, and WSOP+ App Integration -

News 12:57, Dec 04SCOOP 2026 Swaps Seasons: PokerStars Moves up Spring Series

News 12:57, Dec 04SCOOP 2026 Swaps Seasons: PokerStars Moves up Spring Series -

News 12:20, Dec 04888poker’s December Festival Is Here, with Freerolls Every Sunday

News 12:20, Dec 04888poker’s December Festival Is Here, with Freerolls Every Sunday -

News 19:42, Dec 03Best Online Poker Room Promotions in December 2025

News 19:42, Dec 03Best Online Poker Room Promotions in December 2025

-

News 08:13, Dec 03Nik Airball Joins CoinPoker as Ambassador With Heads-Up Promo

News 08:13, Dec 03Nik Airball Joins CoinPoker as Ambassador With Heads-Up Promo -

News 19:10, Dec 02“I always enjoyed games & solving problems”: Mario Mosböck AMA on Reddit

News 19:10, Dec 02“I always enjoyed games & solving problems”: Mario Mosböck AMA on Reddit -

News 14:33, Dec 02JackPoker Launches Turbo Series: Festive Ride With $650K GTD

News 14:33, Dec 02JackPoker Launches Turbo Series: Festive Ride With $650K GTD -

News 17:18, Dec 01BSOP Online Returns to PokerStars This December

News 17:18, Dec 01BSOP Online Returns to PokerStars This December -

News 13:01, Dec 01PokerListings Christmas Daily Freerolls will run from December 1 to 25 at ACR Poker

News 13:01, Dec 01PokerListings Christmas Daily Freerolls will run from December 1 to 25 at ACR Poker -

News 14:49, Nov 30GGPoker Became the Title Sponsor of Triton Poker Paradise

News 14:49, Nov 30GGPoker Became the Title Sponsor of Triton Poker Paradise -

News 21:06, Nov 29iPoker Network Expands Partnerships with Live Poker Brands

News 21:06, Nov 29iPoker Network Expands Partnerships with Live Poker Brands -

News 10:30, Nov 28Poker Room Promotions for Black Friday

News 10:30, Nov 28Poker Room Promotions for Black Friday -

News 12:08, Nov 28The Festival Bratislava: Highlights From a Record-Breaking Week For The Festival Series

News 12:08, Nov 28The Festival Bratislava: Highlights From a Record-Breaking Week For The Festival Series -

News 11:24, Nov 27PokerListings Freerolls Passwords — November 27

News 11:24, Nov 27PokerListings Freerolls Passwords — November 27 -

News 11:51, Nov 27Nordic Masters Underway at Gran Casino Murcia Odiseo

News 11:51, Nov 27Nordic Masters Underway at Gran Casino Murcia Odiseo -

News 15:27, Nov 26WPT Global Is Back With Christmas & New Year Giveaway

News 15:27, Nov 26WPT Global Is Back With Christmas & New Year Giveaway -

News 15:30, Nov 25Four Cities, One Season: 888poker LIVE in 2026

News 15:30, Nov 25Four Cities, One Season: 888poker LIVE in 2026 -

News 13:39, Nov 25Winter is Coming to iPoker With Over €12,500,000 GTD in December Promotions

News 13:39, Nov 25Winter is Coming to iPoker With Over €12,500,000 GTD in December Promotions -

News 15:04, Nov 26OP-ED: When the Bar Is Low, Don’t Dig for Gold — WPT’s Non-Merky Branding Problem

News 15:04, Nov 26OP-ED: When the Bar Is Low, Don’t Dig for Gold — WPT’s Non-Merky Branding Problem -

News 15:31, Nov 24What’s Next for Sweepstakes Casino Gaming?

News 15:31, Nov 24What’s Next for Sweepstakes Casino Gaming? -

News 09:59, Nov 25It Turned Out That WSOP Documentary Contains Fake Quotes of Alan Keating

News 09:59, Nov 25It Turned Out That WSOP Documentary Contains Fake Quotes of Alan Keating -

News 12:47, Nov 24Hyper One Hour: Fast-Paced Tournaments on JackPoker

News 12:47, Nov 24Hyper One Hour: Fast-Paced Tournaments on JackPoker -

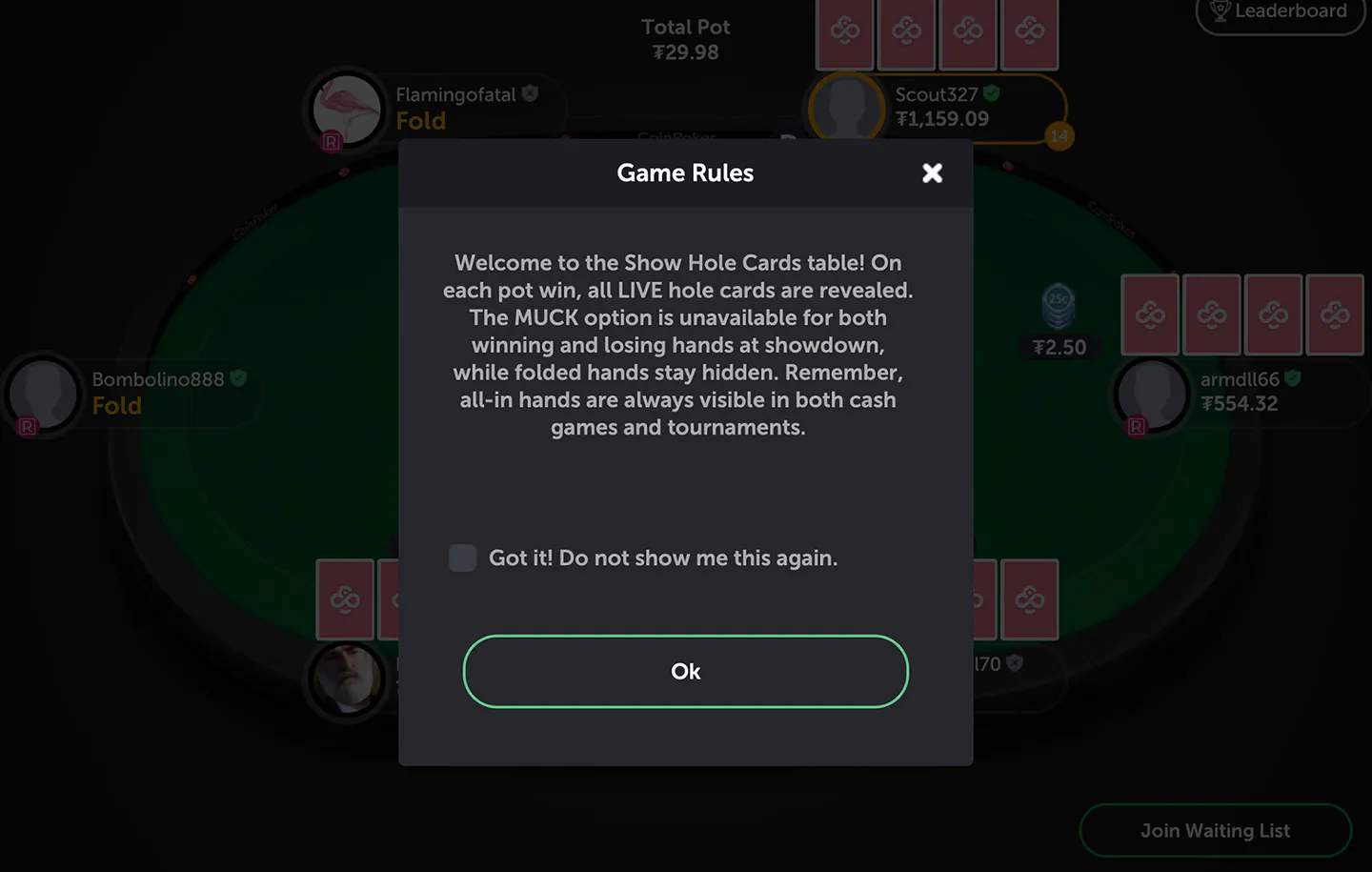

News 16:06, Nov 21PLO $2/5 Show Tables Now Available on CoinPoker

News 16:06, Nov 21PLO $2/5 Show Tables Now Available on CoinPoker -

News 17:59, Nov 21DraftKings and FanDuel Exit Nevada, Leaving WSOP as the Sole Online Poker Operator

News 17:59, Nov 21DraftKings and FanDuel Exit Nevada, Leaving WSOP as the Sole Online Poker Operator -

News 14:59, Nov 20WPT Global Partners with Dublin Poker Festival for 2026

News 14:59, Nov 20WPT Global Partners with Dublin Poker Festival for 2026 -

News 08:31, Nov 20“I don’t think tournament poker is poker. It’s a lottery!”: Alan Keating appears in NO LIMIT Docuseries

News 08:31, Nov 20“I don’t think tournament poker is poker. It’s a lottery!”: Alan Keating appears in NO LIMIT Docuseries -

News 12:07, Nov 19Court Ruling Opens the Door to Shared Liquidity for Ontario Online Poker

News 12:07, Nov 19Court Ruling Opens the Door to Shared Liquidity for Ontario Online Poker -

News 10:02, Nov 18JackPoker Launches $600K Black Friday Rewards Promo Ahead of 300 Millionth Hand

News 10:02, Nov 18JackPoker Launches $600K Black Friday Rewards Promo Ahead of 300 Millionth Hand

For nearly two decades PokerListings has been covering the biggest moments in poker – from the legendary WSOP 2006 in Las Vegas to the shock of Poker Black Friday in 2011 and the launch of the first fully legal US online poker room. Today, we continue that tradition with fresh daily updates, breaking news, tournament coverage, player stories, and expert insights that keep you connected to the fast-moving poker world.