Best Luxon Pay Poker Sites for 2025

Luxon Pay has emerged as a reliable and innovative payment solution, especially for poker enthusiasts seeking seamless transactions. The best Luxon Pay poker sites for [yea] provide players with confidence, thanks to this eWallet’s emphasis on safety and security.

The company also processes deposits and withdrawals without hidden fees, making it a favorite among global players. With Luxon Pay deposit options and a hassle-free setup, managing your poker bankroll has never been easier. If you’re looking to play poker with Luxon Pay, this payment system ticks all the right boxes for your gaming needs.

Best Poker Sites That Accept Luxon Pay

Finding the best poker platforms that support Luxon Pay can elevate your gaming experience. To save yourself some time researching, you can refer to our list of the best poker sites that accept Luxon Pay:

What Is Luxon Pay and How Does It Work

Luxon Pay is a cutting-edge multi-currency eWallet designed to deliver secure, fast, and hassle-free transactions for users worldwide. Its intuitive platform allows individuals to deposit, withdraw, exchange, or transfer money effortlessly, catering to a broad audience, including online poker players.

Available in over 120 countries, it’s a versatile solution for any financial need. Whether you’re topping up your account, transferring funds, or converting currencies, Luxon Pay combines functionality with ease. Now, let’s explore how to deposit money, withdraw winnings, and understand the associated limits and fees.

Deposit Money With Luxon Pay

Depositing money to poker sites with Luxon Pay is a simple process that ensures speed and security for users. Follow these steps to get started:

- Choose a Poker Site: Pick a poker site that accepts Luxon Pay from our chart.

- Register an Account: Sign up on the poker site by providing the required details.

- Go to the Deposit Section: Log in and find the deposit or cashier section on the site.

- Select Luxon Pay: From the list of payment methods, choose Luxon Pay.

- Enter Deposit Details: Input the amount you’d like to deposit and confirm the transaction.

- Fund Your Account: Follow the prompts to complete your Luxon Pay deposit. Your funds will be available instantly.

Withdrawing Money Using Luxon Pay

Withdrawing funds using Luxon Pay is quick and easy. You need to follow these simple steps to complete your withdrawal:

- Log in to Your Poker Account: Access your poker site account using your credentials.

- Go to the Withdrawal Section: Navigate to the cashier or withdrawal page.

- Select Luxon Pay: Choose Luxon Pay as your withdrawal method.

- Enter Withdrawal Amount: Specify how much you wish to withdraw within the minimum and maximum limits.

- Finalize the Process: Confirm the details and authorize the transaction. Your winnings will be sent to your Luxon Pay wallet shortly.

Limits, Fees & Withdrawal Time

To make managing your money easy, Luxon Pay offers clear and transparent information about fees, maximum limits, and withdrawal time. You can find out more about them in the table below:

| Action | Fee | Withdrawal Time | Limits |

|---|---|---|---|

| Deposits into Luxon Pay | No fee | Instantly | Max limit $50,000 |

| Instant transfer to other users | No fee | Instantly | Max limit $50,000 |

| Receive transfers from users | No fee | Instantly | Max limit $50,000 |

| Currency exchange | 0% – 2% | Instantly | Max limit $100 |

| Deposits to Poker Sites | No fee | Instantly | Max limit $50,000 |

| Withdrawals from Poker Sites | No fee | Instantly | Max limit $50,000 |

| Bank Withdrawals (SEPA & UK) | $10 Fee | Instantly | Max limit $50,000 |

| Bank Withdrawals (SWIFT) | $20 Fee | Instantly | Max limit $50,000 |

| Card and ATM withdrawals | No fee | Instantly | Max limit $50,000 |

When it comes to limits, fees and processing times when using Luxon Pay on poker sites, the data varies significantly. To make sure that you are okay with terms of the site you are interested in, make sure to check their policies beforehand.

Legal Status of Playing Poker With Luxon Pay

Luxon Pay stands as a trustworthy and secure option for poker enthusiasts, thanks to its licensing and regulation by the Financial Conduct Authority (FCA) in the United Kingdom. The FCA accreditation ensures that Luxon Pay adheres to strict financial and operational standards, offering users confidence in the platform’s legitimacy.

Whether you’re depositing funds, transferring winnings, or simply managing your poker transactions, you can rely on Luxon Pay’s robust oversight to safeguard your money. This regulatory framework not only guarantees security but also highlights Luxon Pay’s commitment to transparency, making it a reliable choice for players around the world.

Pros & Cons of Using Luxon Pay in Online Poker

When considering Luxon Pay for online poker, it’s important to weigh both its strengths and limitations. Below is a balanced overview of the key benefits and potential drawbacks, helping you decide if this platform aligns with your gaming needs.

- No Fees. Enjoy deposits and withdrawals from poker sites without any fees.

- User-Friendly Interface. The platform is easy to use, streamlining transactions for players.

- Flexible Currency Exchange. Competitive fees ranging from 0% to 2%, depending on your user tier.

- Personalised Approach. Higher-tier users benefit from reduced fees and additional perks.

- Fees for Standard Users. Standard users may incur higher costs for currency exchange and withdrawals.

- Limited Features for Lower Tiers. Premium features are reserved for Noir and Premium users.

Luxon Pay’s VIP Program

Discover how Luxon Pay’s tiered VIP program caters to a variety of user needs, offering unique benefits at every level and rewarding loyalty with exclusive perks.

Standard

The Standard tier is the entry-level option, available to all users without any deposit requirements. While it doesn’t come with the added perks of higher tiers, it still grants access to Luxon Pay’s secure and user-friendly wallet services. Standard users can enjoy basic money transfers, deposits, and withdrawals with access to competitive exchange rates.

Classic

To achieve the Classic tier, users need to deposit between $3,000 and $9,999 per quarter. Classic members unlock lower transaction fees, benefiting from reduced costs on services such as currency exchange. Additionally, they enjoy slightly higher transaction limits compared to Standard users.

Premium

The Premium tier requires quarterly deposits ranging from $10,000 to $29,999. Premium members gain access to even greater benefits, including significantly lower fees and further increased limits on transactions.

Noir

Noir is the highest and most exclusive tier, reserved for users who deposit over $30,000 per quarter. Noir members receive the ultimate Luxon Pay experience with minimal fees, the highest transaction limits, and premium customer support. This tier offers priority services, ensuring seamless transactions and unmatched convenience.

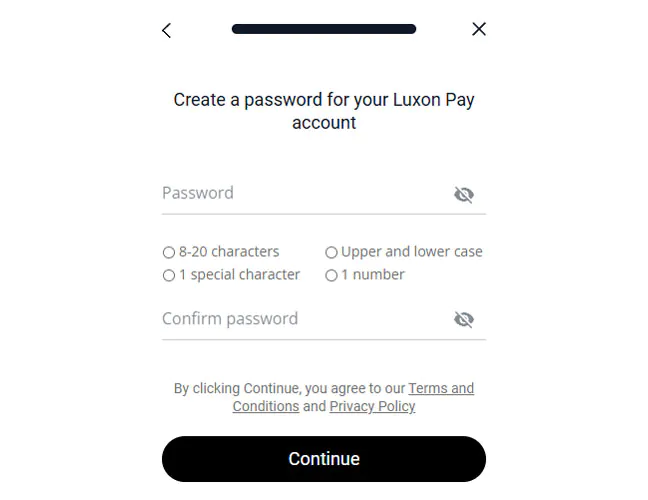

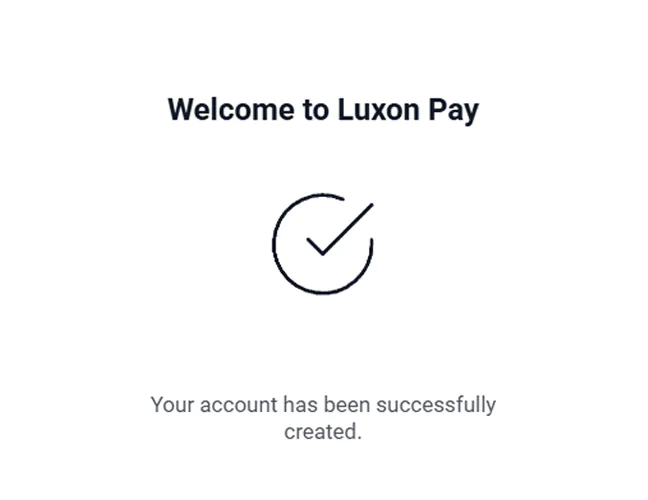

How To Sign Up for Luxon Pay

Creating a Luxon Pay account is simple and only takes a few minutes. Follow these steps to get started:

Visit the Luxon Pay website and click the registration button in the upper right corner;

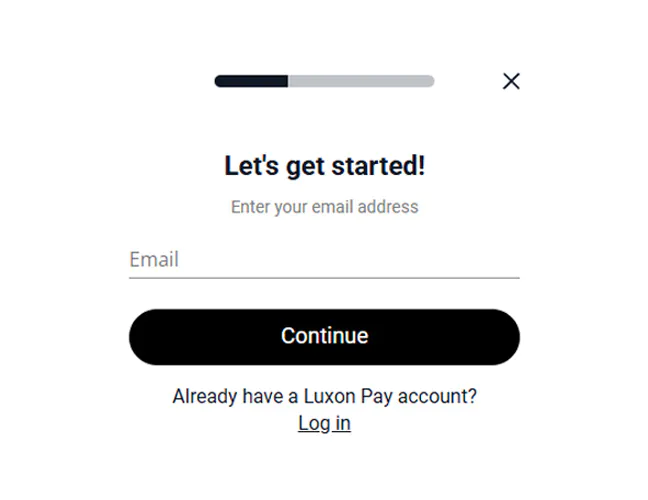

Begin by entering your email in the sign-up section;

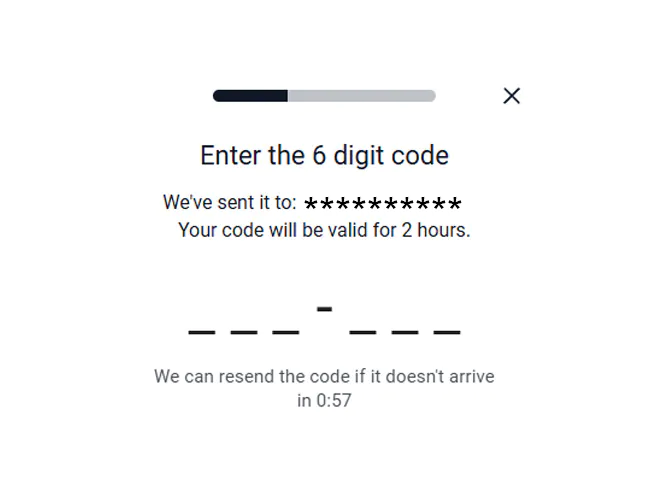

Check your inbox for a verification code sent by Luxon Pay. Enter the code in the designated field to confirm your email address;

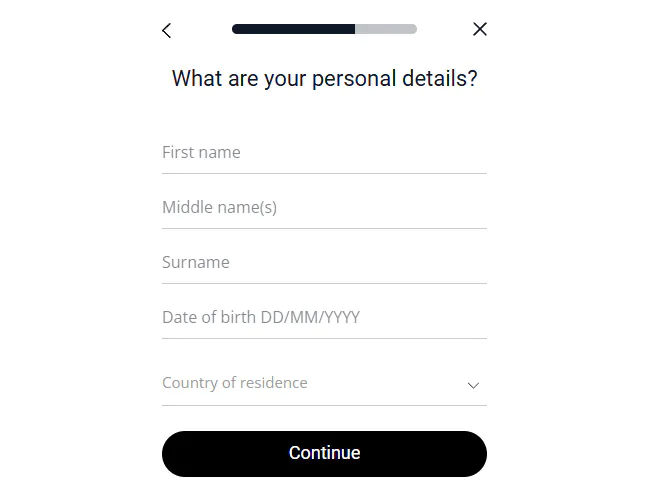

Complete the form by entering your first name, middle name(s) (if applicable), surname, date of birth (DD/MM/YYYY), and country of residence;

Create a strong and unique password to keep your account safe;

Review the details, agree to the terms and conditions, and submit your application

Verification Process

To increase your Luxon Pay limits, verify your identity using a passport, driver’s license, or ID card, and upload a photo of your face. For address verification, provide a utility bill or bank statement showing your name, correct address, and dated within the last six months. Use your phone for convenience, taking clear photos or saving documents as PDFs. The process includes a quick automated review, followed by manual approval, ensuring secure and smooth verification.

Tips for Using Luxon Pay for Online Poker

Luxon Pay offers a seamless and secure way to manage your finances while playing online poker. To maximize your experience, follow these tips:

- Monitor Transaction History: Regularly review your Luxon Pay transaction history to track spending and stay organized with your bankroll. This helps you stay on top of your gameplay budget.

- Multi-Currency Support: Avoid exchange hassles by using Luxon Pay’s built-in currency converter.

- Enable Security Features: Activate security settings provided by Luxon Pay for extra protection. Safeguarding your eWallet keeps your funds and personal data secure while you enjoy poker.

- Leverage VIP Benefits: Climb the VIP tiers for higher limits, better rates, and priority services.

By using Luxon Pay wisely, you can focus on your game and enjoy an enhanced poker experience!

Features of Luxon Pay for Online Poker

Luxon Pay is designed to meet the unique needs of online poker players, offering a range of advanced features that combine flexibility, convenience, and innovation. Whether you’re managing multiple currencies or exploring trading opportunities, Luxon Pay provides the tools to streamline your poker experience. With seamless transactions, diverse currency options, and cutting-edge financial solutions, you can focus on your game without worrying about your finances. Get ready to discover how these features can elevate your online poker adventures.

Multi-Currency Wallet

Luxon Pay’s Multi-Currency Wallet provides unmatched versatility for online poker enthusiasts, supporting an extensive range of currencies for seamless financial management. A small fee applies for conversions, but Noir VIP users enjoy this service without any fees.

AUD, BHD, BRL, GBP, BGN, CAD, CZK, DKK, EUR, HKD, HUF, IDR, ILS, JPY, JOD, KWD, MXN, MAD, TWD, NZD, NOK, OMR, PHP, PLN, QAR, RON, RUB, SAR, SGD, ZAR, KRW, SEK, CHF, THB, TND, TRY, AED, and VND.

This extensive currency support offers poker players utmost flexibility and convenience, letting you focus on the game while Luxon Pay handles the rest.

Cryptotrading

Luxon Pay brings the power of cryptocurrency trading to online poker enthusiasts through its partnership with Coin Rivet. By linking your Coin Rivet account to Luxon Pay with just a few clicks, you unlock the ability to buy and sell cryptocurrencies seamlessly.

Currently, you can trade popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This feature adds a new level of financial flexibility, ensuring you can deposit and play even on sites that accept only crypto.

Mobile Poker Apps That Accept Luxon Pay

Finding mobile poker apps that accept Luxon Pay can make your gaming experience even more seamless and convenient. To streamline your research, explore our curated list of mobile poker apps that accept Luxon Pay:

Luxon Pay’s Customer Support

At Luxon Pay, providing exceptional customer support is a top priority. If you have questions, encounter difficulties, or need help with your account, there are several support options available to ensure you are always covered.

- Live Chat 24/7: Get real-time help anytime, day or night, through the dedicated live chat feature;

- Email Support: Reach via email at [email protected] for detailed inquiries or more complex issues;

- Comprehensive FAQ Section: Explore a wide range of answers to common questions, ensuring quick solutions without needing direct support.

Best Alternatives for Luxon Pay Payments

While Luxon Pay offers an excellent payment solution for online poker players, exploring other reliable options can ensure you find the method that best fits your needs. Here are some of the top alternatives:

- MuchBetter. Known for its user-friendly mobile app, MuchBetter is a popular choice for online poker players.

- Skrill. As a widely accepted e-wallet, Skrill supports multiple currencies and is perfect for players who value flexibility.

- AstroPay. AstroPay enables seamless online payments without requiring a bank account, offering easy prepaid card options for safe and private transactions.

- ecoPayz. ecoPayz provides a secure way to store and transfer funds, with multi-currency support and no need for a bank account, making it a solid choice for players worldwide.

FAQs About Luxon Pay

Where is Luxon Pay currently available?

Luxon Pay is available in many countries worldwide and can be used to make deposits and withdrawals to/from many poker and gambling platforms.

Is Luxon Pay safe & secure for online poker?

Yes, it uses advanced encryption and security measures to ensure your funds and personal information are protected, making it a trusted payment solution for those looking to play poker with Luxon Pay.

What deposit methods does Luxon Pay offer?

Luxon Pay supports a range of deposit methods, including credit and debit cards, bank transfers, and multiple e-wallets, giving you flexibility on any Luxon Pay poker site.

How much can I deposit with Luxon Pay?

Deposit limits may vary based on your account verification level and the poker site requirements.

Can I withdraw money from poker sites using Luxon Pay?

Yes, Luxon Pay allows smooth withdrawals from poker sites, enabling easy access to your winnings.

Are there deposit and withdrawal limits with Luxon Pay for poker?

Limits depend on the poker site you’re using and your Luxon Pay account status.

Why use Luxon Pay for online poker?

Luxon Pay offers instant deposits, multi-currency support, and fee-free options for Noir VIP users, enhancing the convenience of managing your poker bankroll.

Will I get a welcome poker bonus if I use Luxon Pay?

It depends on the poker site you choose, most of them allow you to get a welcome bonus using Luxon Pay.

Can I use Luxon Pay for US poker sites?

Yes, you can use Luxon Pay for US poker sites, but it depends on the state you live in.

Does Luxon Pay charge a commission?

No, deposits and withdrawals are fee-free with Luxon Pay. Note, however, that some poker sites might put their own fees in place.

-

- 100% up to $2000

T&Cs Apply | Play Responsibly | GambleAware

18+ | Play Responsibly | T&C Apply

-

CoinPoker4.1

- 33% Weekly

- 150% up to 2000$

T&Cs Apply | Play Responsibly | GambleAware

+18 / T & C apply / Play responsible

-

Stake.US Poker4.3

- Rakeback 5%

- $55 Stake Cash + 260K Gold Coins

T&Cs Apply | Play Responsibly | GambleAware

18+ | Play Responsibly | T&C Apply

-

- 100% up to $1000

T&Cs Apply | Play Responsibly | GambleAware

T&Cs Apply | Play Responsibly | GambleAware

-

T&Cs Apply | Play Responsibly | GambleAware

18+ | T&Cs Apply | Play Responsibly | GambleAware

User Comments

Don’t use luxon pay ! .. totally ridiculous requirements for deposits.. they want your bank statement EVERYTIME even though you just sent it the day before, but just any monthly bank statement your second one needs to be a 72 HOURS OLD STATEMENT! WHAT A LOAD OF BULLSXXXX !